Business Inventory Growth Has Been Tumbling

If you want to know where the U.S. economy could be headed, look at what businesses are doing.

As it stands, businesses are pessimistic, which tells me the U.S. economy could be headed toward a rough patch. A recession could be brewing, and it could be severe.

A few ways to measure business sentiment is to look at what they’re doing with their inventory levels, how they think their revenue growth will look over the coming year, and what they think their employee count will be over the coming year.

The recent inventory figures say businesses are worried, expecting something wicked to come to the U.S. economy.

What do inventory levels really tell us?

Businesses build up their inventories when they think they’ll sell more products. If inventories aren’t growing as much as before—or are declining—it’s a sign that businesses expect an economic slowdown. Businesses see the conditions changing well before the changes show up in the economic data, and they tend to adjust to changes very quickly.

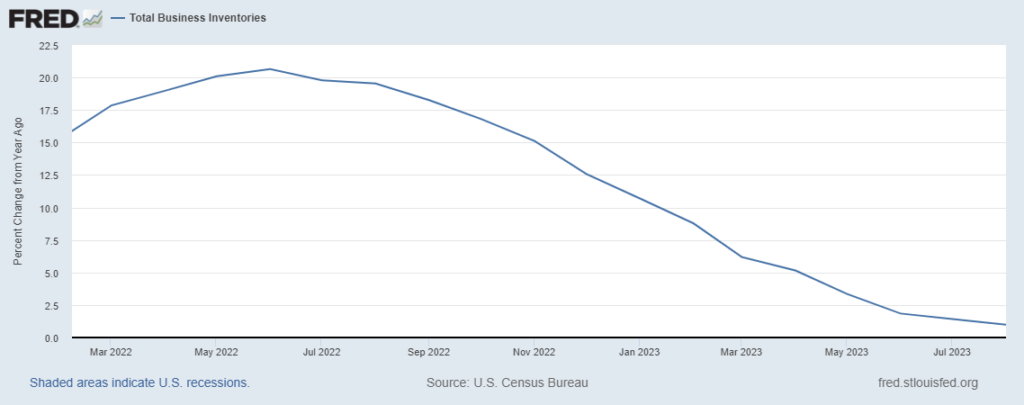

Look at the chart below, which plots the year-over-year changes in U.S. business inventories.

In August 2022, business inventories grew at a rate of close to 20%, compared to the same period a year earlier. In August 2023, they grew by less than one percent year-over-year!

This shouldn’t be overlooked. If businesses aren’t building inventories, will they keep their employees?

(Source: “Total Business Inventories,” Federal Reserve Bank of St. Louis, last accessed November 1, 2023.)

Businesses Say Revenue Growth Won’t Be as High as Before

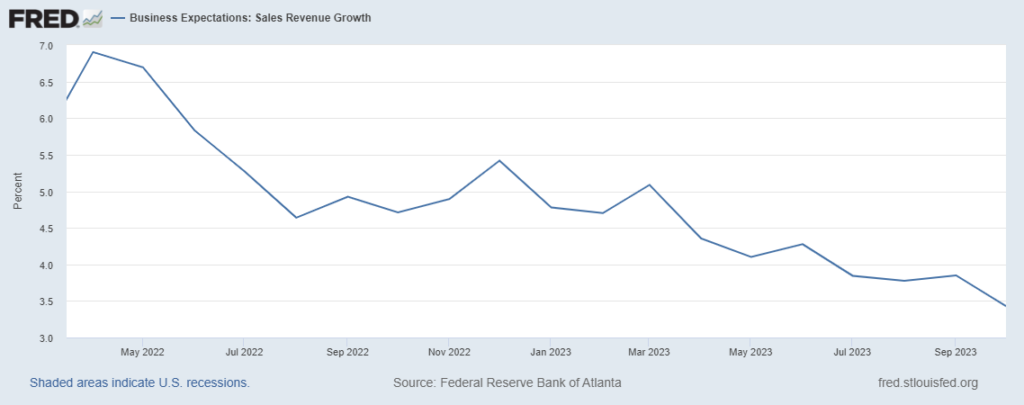

Moving on, take a look at how businesses see their future sales revenue growth; it isn’t a rosy picture.

The below chart shows what businesses in the U.S. economy think their revenue growth will be in a year.

In early 2022, businesses were optimistic, expecting revenue growth of close to seven percent. Now, they expect revenue growth below 3.5%. That’s 50% lower than not too long ago. If the trend is any indicator, these expectations could go down even further.

(Source: “Business Expectations: Sales Revenue Growth,” Federal Reserve Bank of St. Louis, last accessed November 1, 2023.)

Employment Growth Won’t Be as Hot as Before

Finally, and possibly the most important question: How do businesses think their employment growth will look in the near future?

The chart below plots what businesses in the U.S. economy think their employment growth will be like over the next 12 months.

Employment growth expectations have been tumbling. In early 2022, businesses expected their workforce to increase by about three percent over the following 12 months. Now, they expect employment growth of less than one percent for that period.

Once again, it’s important to pay attention to the trend, which currently says expectations could get a lot worse.

(Source: “Business Expectations: Employment Growth,” Federal Reserve Bank of St. Louis, last accessed November 1, 2023.)

If Recession Follows, Stock Market Could Plummet

Dear reader, if I look at the above three charts and nothing else, it tells me that businesses are bracing for a recession in the U.S. economy.

I’m not in the business of predicting exactly when the next recession will begin, but all the bases are loaded for a recession in the U.S. economy, and it’s going to have a negative impact on the stock market.

Here’s something worth noting: historically, the stock market hasn’t bottomed before a recession. If we assume that this will continue to be the case, then the stock market’s lows in October 2022 could be tested once again. The S&P 500 currently trades about 18% above those lows. So, the downside could be immense.

Investors getting complacent could mean significant damage to their stock portfolios.